Mailchimp's Customer-Friendly Way of Using Customer Data

Alfred Lua / Written on 22 May 2020

Hello there!

A bulk of my time in the last six months was spent on testing bundle offerings for people who want to try multiple Buffer products. I ran two experiments. Earlier this week, I shared with paying subscribers everything about the first experiment. It is a long 2,000-word essay including the challenges I faced getting the project to move forward and the results I shared with the team. If you're interested, you can read it here.

Today, let's talk about my favorite monkey, Mailchimp!

Mailchimp's campaign benchmarking

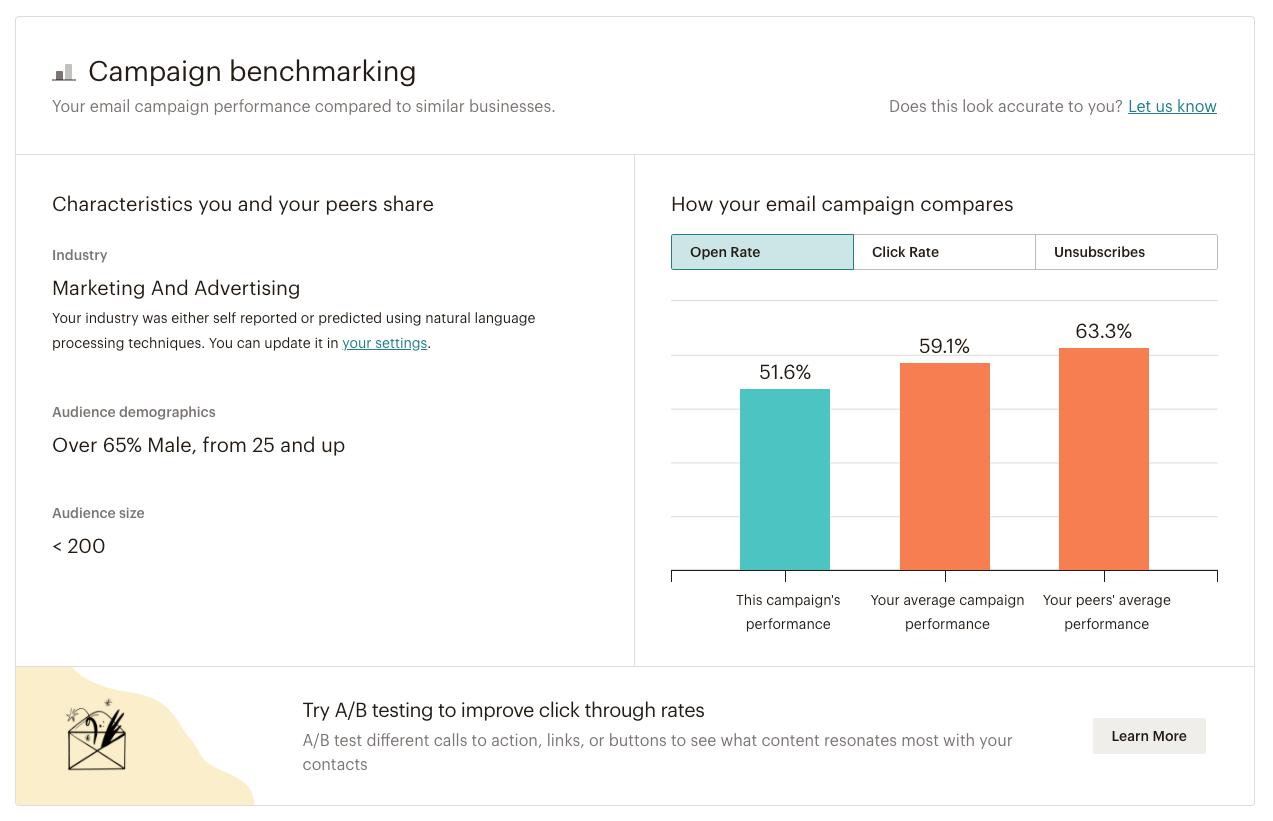

Earlier this year, Mailchimp launched a new campaign benchmarking feature to help customers compare their email performance with other businesses in the industry.

Market smarter with audience and campaign performance data

Now you can find out how you stack up against your peers by monitoring new campaign benchmarking data. Celebrate when you’re doing better than average, and use our recommendations to learn how to improve your future email campaigns.

This is how the previous Weekly Analyses did. I need to up my game!

I chanced upon it myself when I was checking out the performance of a recent Yeti Distro email. I thought it is a great idea and it was well-executed. Here's why:

This is how the previous Weekly Analyses did. I need to up my game!

I chanced upon it myself when I was checking out the performance of a recent Yeti Distro email. I thought it is a great idea and it was well-executed. Here's why:

An actual fair trade

First, this is valuable data for customers.

As a marketer myself, I know benchmarking is something that all, if not most, marketers crave. And this goes beyond email marketing.

Is my open rate good?

Is my engagement rate good?

Is my website traffic good?

Being able to compare our metrics with the industry averages is valuable because it gives us a relative measure of how well we are doing. If our metrics are above average, we should double down on what we have been doing. Otherwise, we should probably change some things.

This has led to "market intelligence" tools to help marketers find out how their peers and competitors are doing. For example, we use Ahrefs to understand the backlink profile of other blogs, HypeAuditor to see the average engagement rate of YouTube videos and Instagram posts, and SimilarWeb to get other websites' traffic statistics.

But to provide the benchmarks in Mailchimp, it needs data of its customers' emails and company. This is where I feel Mailchimp has stood out from many other companies. Many companies, including Buffer, collect customer data for their own benefit (e.g. marketing and product development purposes, which I'll elaborate below) without providing immediate tangible value for their customers.

Mailchimp has created a fair trade.

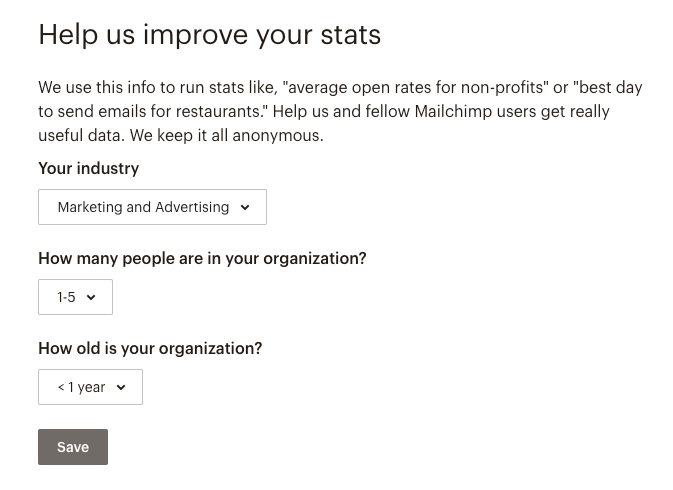

"Tell us about your business, and we'll tell you how your email campaigns are performing, compared with similar businesses". Mailchimp gets the data it wants but the customers also get a valuable piece of insight that, I'm sure, some would pay for. Now they get it for free just by answering what industry they are in. [1]

"Tell us about your business, and we'll tell you how your email campaigns are performing, compared with similar businesses". Mailchimp gets the data it wants but the customers also get a valuable piece of insight that, I'm sure, some would pay for. Now they get it for free just by answering what industry they are in. [1]

I also appreciate how transparent Mailchimp is about using such data and how it is possible to opt-out of its data analytics projects.

Even if I were to opt-out of Mailchimp's data analytics projects, Mailchimp doesn't take away the campaign benchmarking from me.

A well-executed, average idea is better than a poorly executed, great idea.

Using customer data to build a better company

I think it's important for companies to always think about how collecting and using customer data can benefit customers immediately first. Then how that can benefit companies themselves.

Companies like to say they use customer data to provide better marketing and improve their products. These tend to be benefits for the company, wrapped in a nice language. Customers don't want to be bombarded by marketing, and few companies actually do better marketing with the data they have collected. And being asked to fill out a survey while trying to use the product can be annoying.

But I won't deny that having more customer data is helpful. It is really useful for companies!

At Buffer, one thing that we have been working on in the past year is understanding the breakdown of our customers so that we can improve our product and do better marketing.

(To be clear, this is to our benefit more than our customers', and I think we can improve here.)

Product

If you are building for everybody, you're building for nobody.

We used to build Buffer for every type of businesses that are using social media: SaaS, publishers, agencies, government organizations, e-commerce, etc. But each of them has different needs. Agencies managing hundreds of social media accounts want different features from e-commerce brands that manage only about five social media accounts at most. SaaS companies care a lot more about Twitter than e-commerce brands care about Instagram.

I felt we ended up with a product that is okay for everyone but not great for anyone.

By knowing the industry breakdown of its customers, Mailchimp can better segment its customers and identify the most profitable segments. You can see from its homepage that it is currently focusing on e-commerce and retail, mobile and web apps, and startups:

After it has identified the customer segments to focus on, it can do more focused research on their needs. Having the data also allows researchers at Mailchimp to more easily survey and interview those customers, then build for them. Mailchimp recently acquired Reaction Commerce, which reinforces its focus on e-commerce customers.

After it has identified the customer segments to focus on, it can do more focused research on their needs. Having the data also allows researchers at Mailchimp to more easily survey and interview those customers, then build for them. Mailchimp recently acquired Reaction Commerce, which reinforces its focus on e-commerce customers.

The data also enables Mailchimp to build a better product experience. For example, during the signup flow, Mailchimp asks if I sell things online. If I answer "Yes", the onboarding flow will guide me to connect my e-commerce store to Mailchimp. This gives me my e-commerce data in Mailchimp and helps me find value in Mailchimp faster. While this sounds pretty straightforward, it can be hard to execute, especially if you don't know which customer segment to build for. Building (and maintaining) different onboarding flows for every possible customer segment also isn't feasible or wise for most companies.

Finally, the data also allows product teams to analyze the product usage, engagement, and churn by customer segment. They could see whether the new features they have built actually improve their product metrics. (At Buffer, we use Mixpanel for our product metrics.)

Nathan Barry, CEO of ConvertKit, wrote about how focusing on a niche helped them gain traction and grow to $15 million ARR:

Choosing a niche is the easiest advice to give and the hardest advice to take. When you don’t have traction, it feels like choosing a niche will exclude the few people who are coming in the door. In reality when we chose “email marketing for professional bloggers” everything changed.

Messaging became clear, the product roadmap was trimmed, and the prospect lists practically wrote itself.

Without that change—without excluding everyone who didn’t fit into the blogger bucket—it would have been incredibly hard to get off the ground.

We eventually expanded to “email marketing for creators,” which now includes podcasters, actors, YouTubers, authors, artists, musicians, and so many more. Even with growing into that larger audience we are still so much more focused than our competitors who target all small-businesses.

Marketing

Similarly, if you are marketing to everybody, you're marketing to nobody.

Generic marketing messages are less effective than specific ones, even for general consumer products. At Buffer, we have also shifted our marketing in the past year. Instead of marketing to all social media managers, we are focusing on e-commerce brands. We created a new podcast about a new direct-to-consumer brand by a top agency, wrote more about social commerce, and focused more on Instagram than Twitter.

Having the industry breakdown data has enabled us to better measure the effectiveness of our marketing. In the past, we could only measure generic metrics such as the number of pageviews and signups. It's great to reach a lot of people but we also want to reach the right group of people. Now, we know how many new signups are e-commerce brands.

Finding that win-win balance

I believe most companies already know the benefits of having more customer data. But it is often at the expense of their customers. Companies collect data because they ultimately want to build a better experience for the customers.

It is a means to an end.

And I think many lost sight of the end—a better experience for customers.

[1]: This is an advantage that incumbents have over startups. With a large user base, incumbents are able to provide more accurate benchmarks, or generally more helpful data, to their customers. Mailchimp's freemium model has helped create this advantage because more users mean more data. By the end of 2019, it has more than 12 million active customers. A new email marketing startup would take a long time to get that number of users. As another example, it is hard for a new website analytics company to compete with Google Analytics in terms of benchmarking because Google Analytics has much more data. (So it should compete in other ways.)