Stripe and the Power of API Companies

Alfred Lua / Written on 31 July 2020

In 2011, Patrick and John Collison, while raising money for their online payments company, Stripe, met Peter Thiel and told him what PayPal had not done well. Thiel, in case you didn't know, is the co-founder of PayPal.

Patrick Collison shared in the interview on How I Built This:

We had a meeting with Peter Thiel, and sort of just as in this conversation we sort of told him structurally what we saw as being all the kind of major flaws in PayPal. Looking back I sort of cringe a little bit at how impolite a guest I must have been. [He's the] cofounder and CEO [of PayPal]. At great length sort of belaboured the point about sort of how they have gotten things wrongly. But Peter, being such a contrarian, was quite sympathetic to this case and decided on the spot to make, you know, a fairly material investment of $200,000.

Nine years since that conversation with Thiel, Stripe is now valued at $36 billion. PayPal, on the other hand, eventually acquired Braintree, another online payments company that started a few years before Stripe, for $800 million in 2013.

High switching cost

One of the key strengths of API companies like Stripe is the high switching cost.

When the perceived switching cost is higher than the actual savings from switching to a new product, we would choose to continue using the existing product. For accepting payments online, both Stripe and Braintree are charging the same amount (2.9% + 30 cents per transaction). So on the financial ground, there isn't any incentive for switching away from Stripe. Furthermore, I think there is an interesting dynamic at play here. Because Stripe is such a technical product, built for developers, any conversations about switching away for financial reasons has to happen between the technical team and the business team, and not just in the business team alone. This extra bit of friction might be enough to prevent such conversations from happening.

There are two costs involved in switching from Stripe. The first is the amount of work needed. For most SaaS products, you can quite easily switch from one to another. Most of the time, you can also export your data from the old tool and import it into the new tool. (They allow this to reduce the switching cost.) But for Stripe and other API companies, there is much more work involved. At Buffer, I believe we are using Stripe's APIs in many parts of our code, such as billing and identifying the plan customers are on to provide or limit access to features. And we are only using one or two of Stripe's 11 products. To move away from Stripe would mean we have to change quite a lot of our code. This should be similar for other companies.

Second, there is also a risk involved in switching away from Stripe. Things could always go wrong during a switch. When it comes to collecting money from customers, most people will have higher hesitation to take such a risk. If all is well, why go through the hassle?

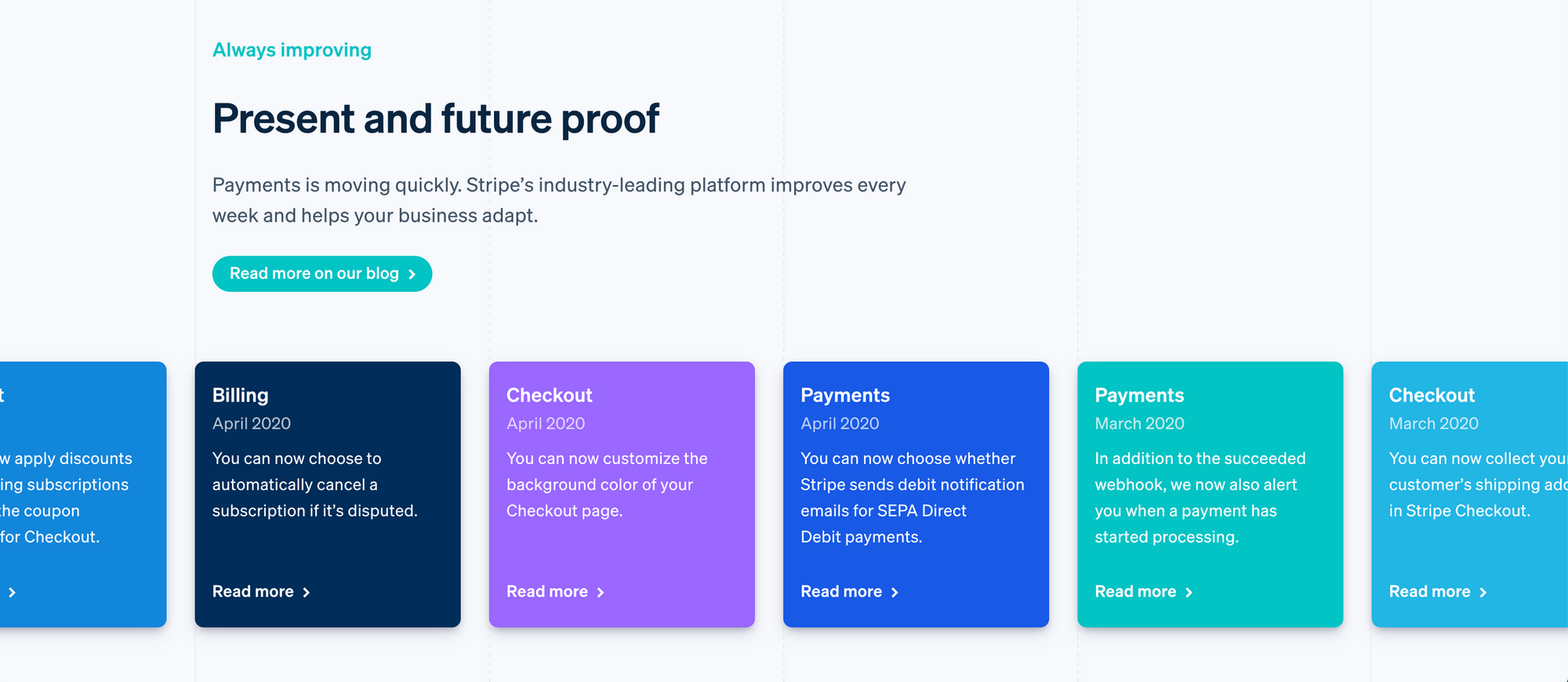

Given all these additional costs from switching, companies need stronger reasons, on top of any financial savings, to switch to another online payments company. What are some other possible reasons? One could be the lack of features that developers really need. Stripe has been shipping hundreds of new features and improvements every year. It even emphasizes this on its website:

While it's still possible for Stripe to miss some things that its competitors identify, a high shipping rate can close most feature gaps and Stripe has to maintain that. That is unless the competitors choose to head down an entirely different direction that Stripe wouldn't want to follow, as explained in Be Unique, Not the Best.

While it's still possible for Stripe to miss some things that its competitors identify, a high shipping rate can close most feature gaps and Stripe has to maintain that. That is unless the competitors choose to head down an entirely different direction that Stripe wouldn't want to follow, as explained in Be Unique, Not the Best.

Another reason could be the lack of coverage for different countries or payment types. This is more of a reason to not adopt Stripe in the first place than to switch from Stripe. Then again, Stripe is available in 39 countries and supports 135 currencies and payment methods. It has also been working hard on this front, adding more payment methods and launching in five more European countries so far this year.

At the beginning of the year, the team decided that they'd add more payment methods to Stripe this year than in all previous years combined. I think they’ll succeed.

May 27: 🇯🇵 JCB June 17: 🇬🇧 Bacs June 22: 🇦🇺 BECS June 24: 🇲🇾 FPXhttps://t.co/cIBq6vEfDG — Patrick Collison (@patrickc) June 25, 2020

With a high switching cost and low incentive to switch, the conversations shift from "are there better alternatives?" to "how can we make better use of Stripe?" For example, at Buffer, we often discuss using more of Stripe's features, such as sending failed payment emails through Stripe instead of hardcoding them into our codebase. This is the best situation for Stripe; customers are essentially locked in and want to use more of its products.

But having a high switching cost isn't an advantage that only Stripe has. Its competitors such as Braintree and Adyen have a similar advantage. Furthermore, switching costs only apply to current customers; Stripe also has to acquire customers first. While the high switching cost due to the difficulty in making technical changes could retain existing customers, a tedious setup process to integrate the APIs deeply in the product can also be a hindrance to attracting new customers. To counter that, Stripe lowers the perceived effort required for implementation and increases the motivation of developers to use its products.

Lower perceived effort

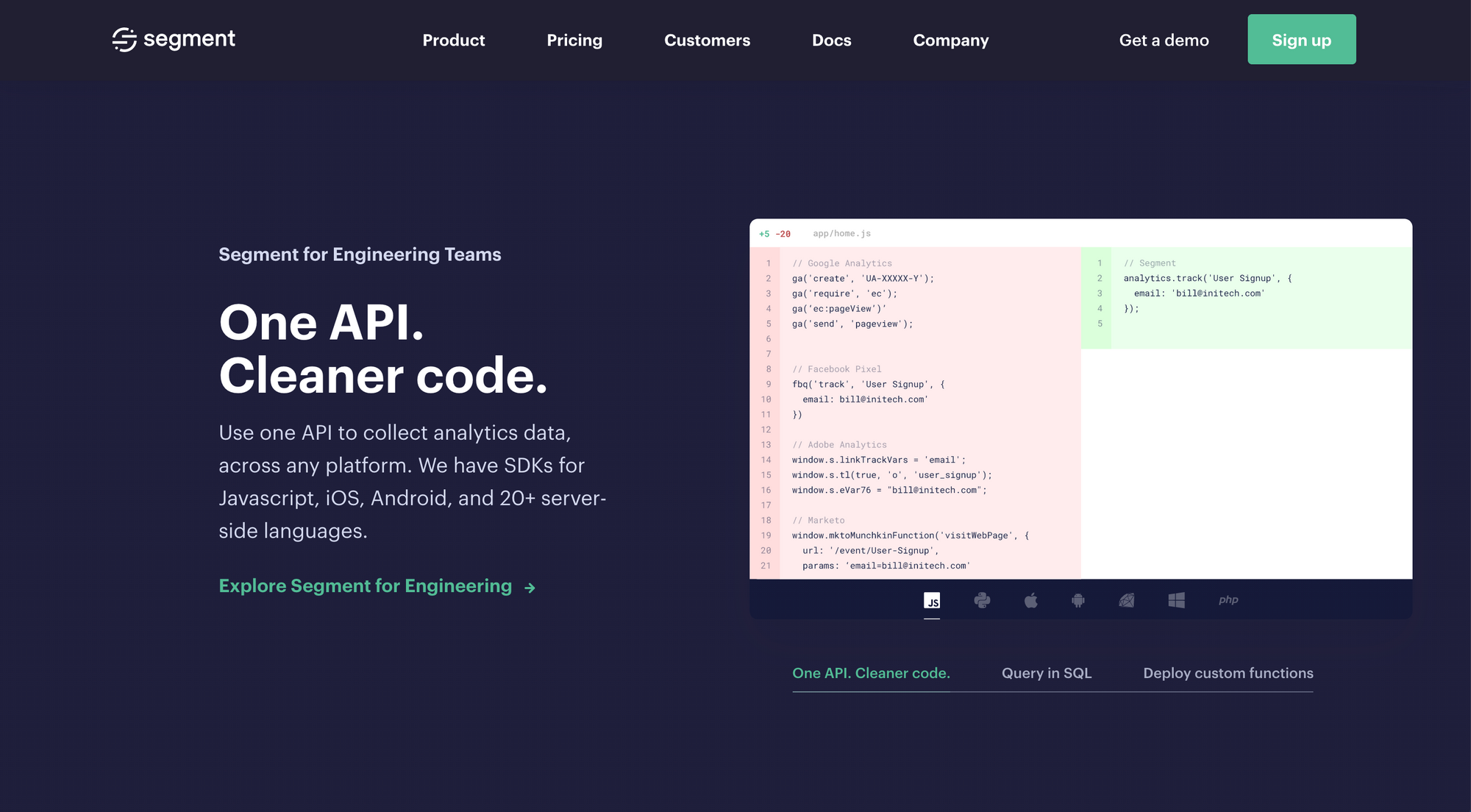

One key difference between Stripe and other online payments companies like Braintree and Adyen is Stripe's focus on developers.

As I mentioned in Marketing Websites and Stripe's Redesign:

Unlike other payments platforms like FastSpring and Adyen, Stripe sells mainly to developers. They betted on the fact that payments infrastructure decisions will eventually be technical decisions and not business decisions. Developers and not business people would decide what payments platform to use. In hindsight, that bet went well for them.

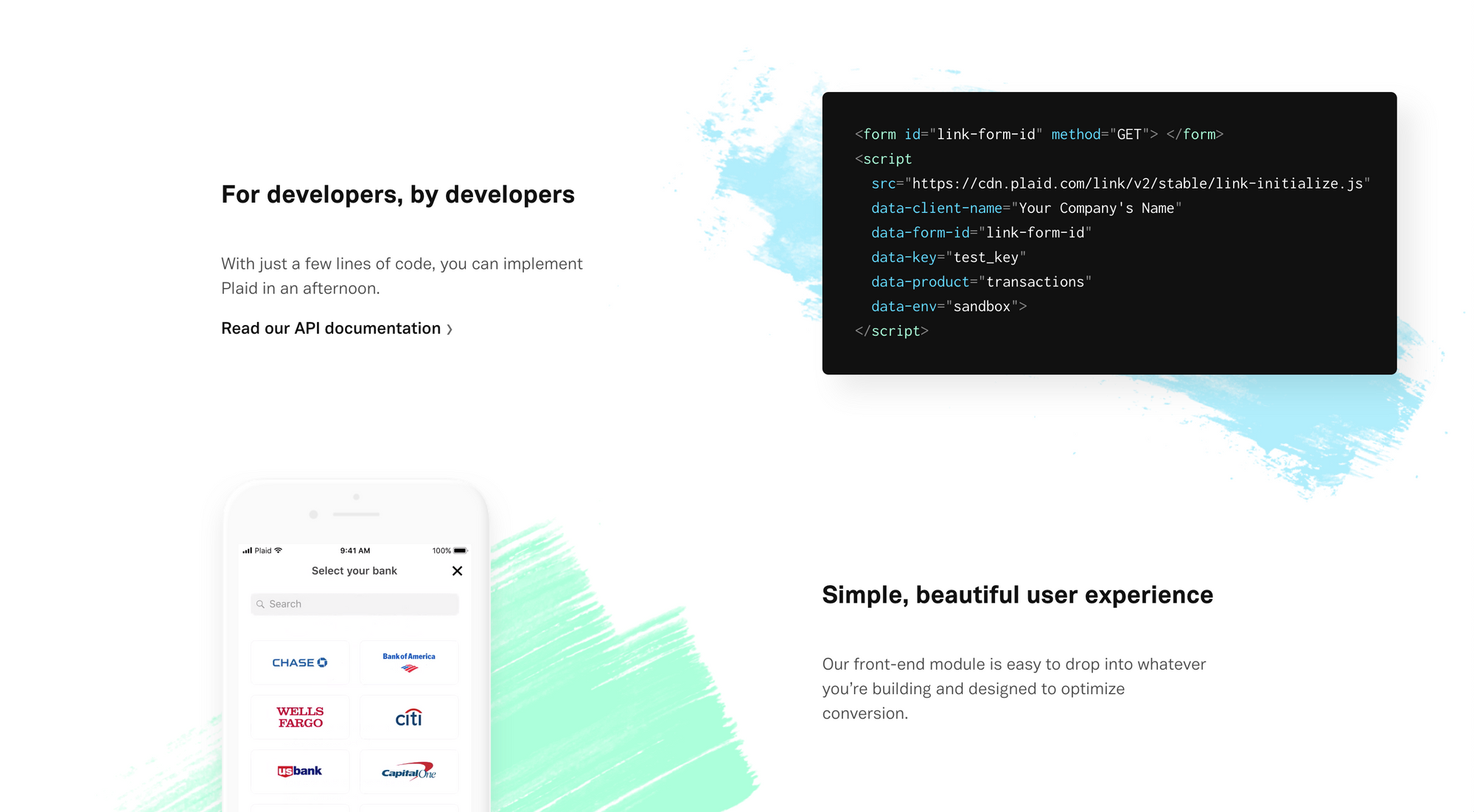

You can see their developer focus all over their marketing website. Quite directly, you see the word, "developers", on most pages. Even better, code is embedded throughout the website, too. The original idea of Stripe is that developers can receive payments online by adding just seven lines of code. The concept of being able to receive payments with just a few lines of code still exists, so it makes sense to show the code on its website.

On the other hand, Braintree listed "Developer knowledge" as one of the things you will need to get started with Braintree:

Developer knowledge Integrating with a payment gateway is a developer’s job. We are renowned for having one of the easiest integrations your developers will ever complete – offering 3 client SDKs (software development kits) for both mobile and web platforms as well as server-side libraries in 6 common languages. While integration times can vary depending on your business, an experienced developer can complete a basic integration with Braintree in less than half an hour.

Stripe targets developers while its competitors target business people. This framing in itself already helps to lower the perceived effort required to implement Stripe. I intentionally discuss "perceived effort" because the actual effort needed is likely similar across the board but it will feel easier to a developer than a non-technical person.

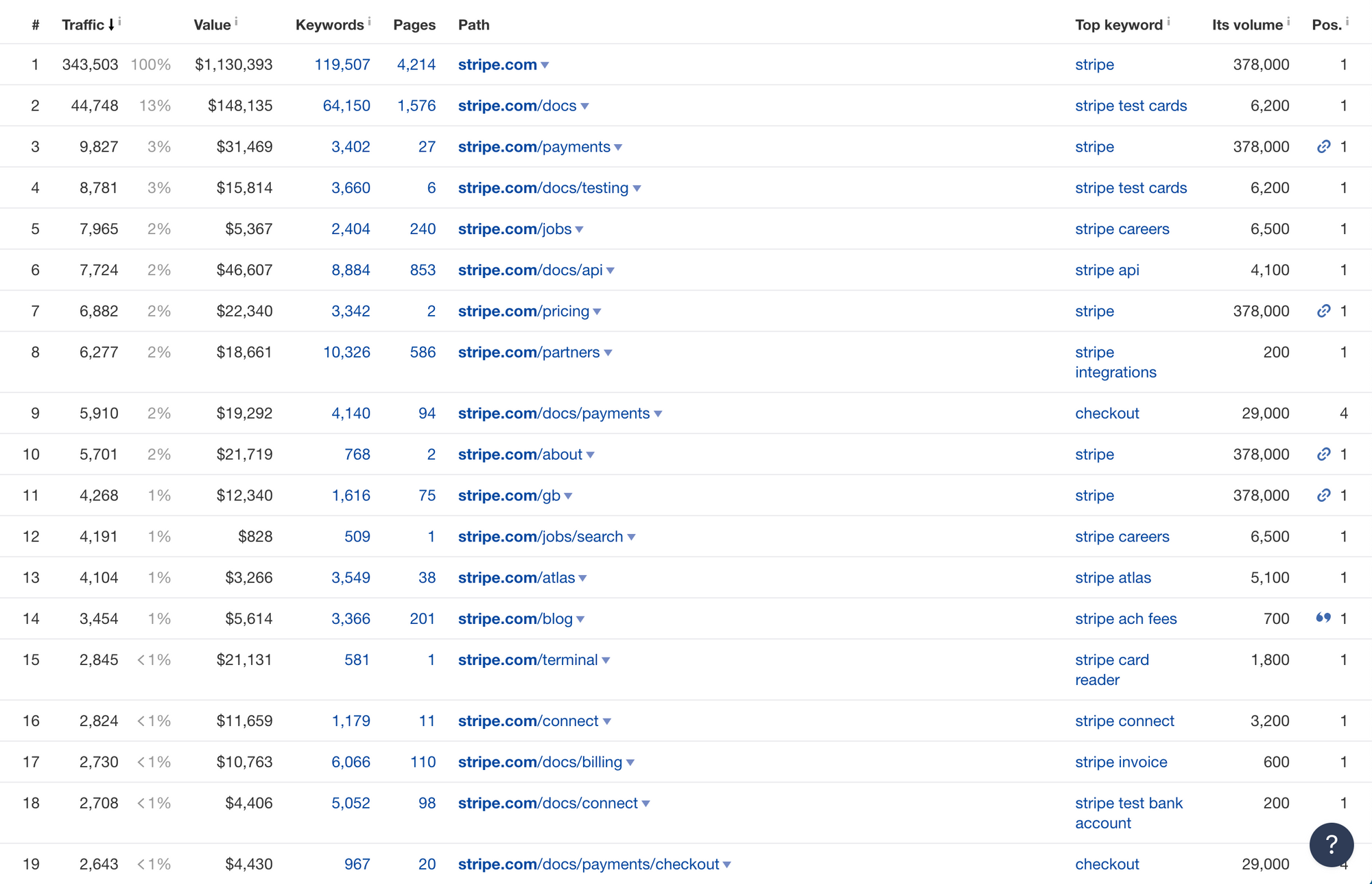

Furthermore, Stripe diligently makes its documentation easy to use and understand. It is often commended as the best documentation, not just in the industry, but ever. I also stated in Marketing Websites and Stripe's Redesign:

After its homepage, Stripe's documentation is the next most visited place on stripe.com. The company probably puts in more than twice the amount of effort into their documentation than other payments companies. Because it is selling to developers, having great documentation is a must-have.

High motivation for adoption

I'd be remiss if I didn't discuss Stripe's branding efforts. Besides reducing the perceived effort to implement its APIs, Stripe also increases developers' motivation for adopting its APIs by building a strong brand. As a company that is building economic infrastructure for the internet, it has done many things to position itself as a forward-looking company with cutting-edge technologies (pardon the fancy adjectives!)

The best branding move, in my opinion, by Stripe has been to acquire Indie Hackers in 2017. Patrick Collison explained the decision on Hacker News:

Patrick from Stripe here. I wanted to quickly chime in to emphasize that our goal in acquiring Indie Hackers is to simply ensure that the site becomes as successful as possible. The Stripe upside we’re hoping for is that more companies get started and that they’re more successful. We already see a very large fraction of new internet companies choose Stripe; we’re mainly hoping that Indie Hackers can help us grow the overall number rather than to grow our fraction. (Our product has to do the latter part.)

This acquisition is beneficial to Stripe in many ways. First, as Collison explained, Indie Hackers has been encouraging more people to start companies. The bigger the pie, the bigger Stripe's piece of the pie. Two years after the acquisition, Courtland Allen, the founder of Indie Hackers, surveyed the Indie Hackers community and discovered 16 percent would not have started a company without their community:

Courtland surveyed the folks at @IndieHackers. 16% of them told him that they would not have started a company without their community. When you run the math, that likely works out to 20,000 – 30,000 companies started because of @IndieHackers. What an amazing site. 😍 https://t.co/RcMPeN8cRN — Patrick Collison (@patrickc) April 23, 2019

This also has the added effect of making tech entrepreneurship, in general, feel more possible. When many people around you are starting tech companies, starting a tech company will feel normal (and you get support from the Indie Hackers community).

Second, because of the high switching costs associated with payments infrastructure, as explained above, Stripe has to acquire new companies before they even try other payments products. With Indie Hackers, Stripe is able to plant its brand in developers' minds beforethey start their companies. Once they adopt Stripe, it's hard, though not impossible, for them to switch.

Finally, some of these new companies will eventually grow into massive enterprises, such as Postmates (acquired by Uber for $2.65 billion) and Lyft (went public at a $24 billion valuation). Sure, only a handful of new companies will have such successes. But by making sure a lot more people are starting companies, Stripe can increase the absolute number of such successes even if the likelihood of success remains the same. Stripe's scalable pricing, charging a percentage for each transaction, and its add-on products, enable it to extract much more value out of each big customer. The long tail of smaller businesses can also contribute significantly to Stripe's revenue, just like millions of small businesses contribute to the majority of Facebook's ad revenue. (The 100 highest-spending brands only account for about six percent of its ad revenue.)

Stripe's other notable branding plays include Stripe Atlas, an easy way to set up a company, Increment, a print and digital magazine about how teams build and operate software systems at scale, and Stripe Press, which publishes books about economic and technological advancement. And, of course, having and showing off the top tech companies as its customers also reinforces its brand.

The power of API companies

Again, while the actual effort required to implement Stripe might be largely similar to other online payments products, Stripe reduces the perceived effort through its focus on developers and documentation and increases the motivation for adopting its products through its branding efforts. All these enable Stripe to acquire customers early, and with the high switching costs, to keep them as customers for a long time.

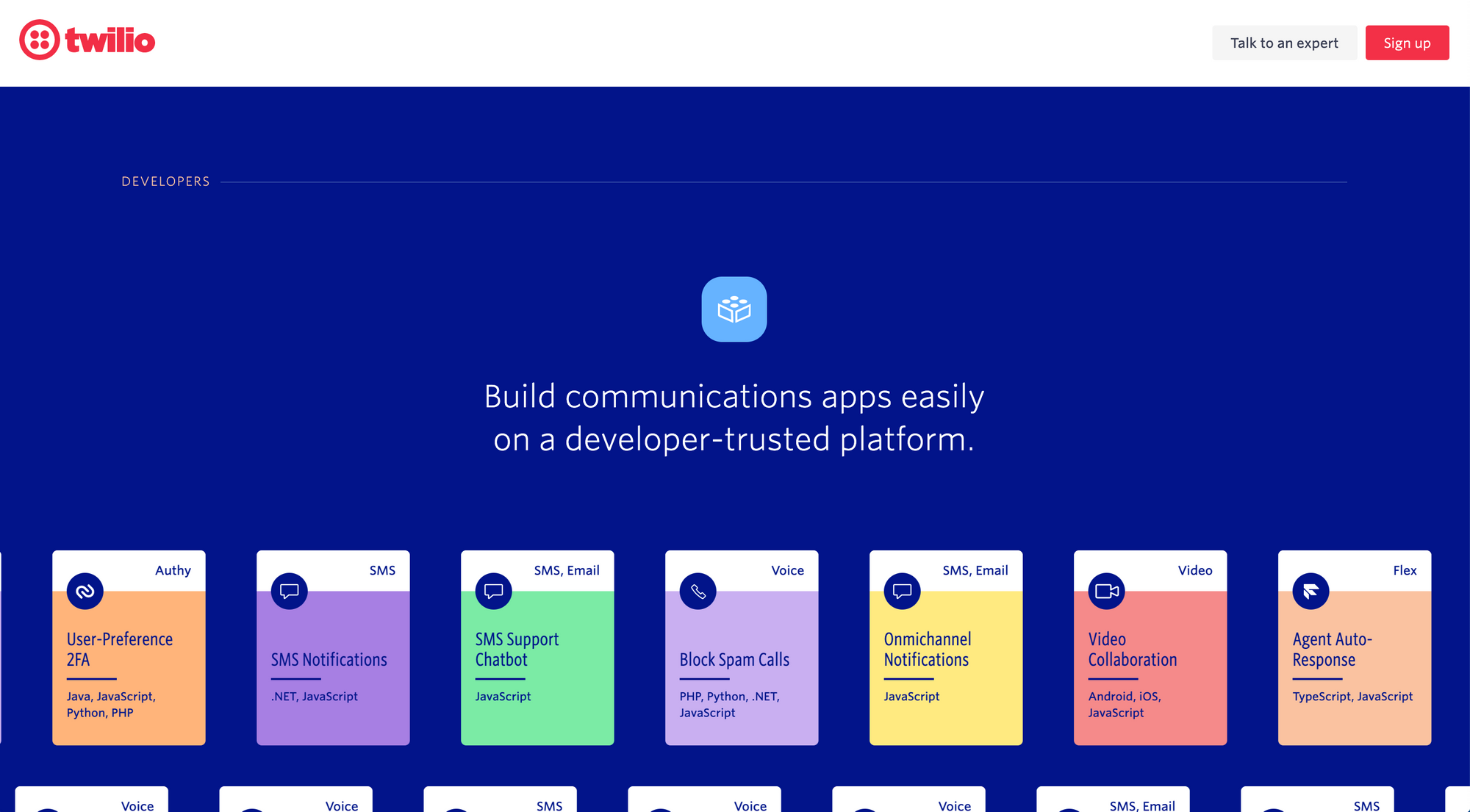

Given the effectiveness of this strategy, it's no surprise other API companies like Twilio, Plaid, and Segment are also using it.